Fast, Secure, and Affordable Money Transfers to India.

Fast, Secure, and Affordable Money Transfers to India.

Best way to send money to India.

You're assured the real exchange rate with the low, transparent fee we're known for.

Join over 500k happy customers who choose Upesi Instant, secure online money transfers.

Perform a one-time payment with Upesi.

You're assured the real exchange rate with the low, transparent fee we're known for.

Join over 500k happy customers who choose Upesi Instant, secure online money transfers.

How much does it cost to transfer money to India?

How much does it cost to transfer money to India?

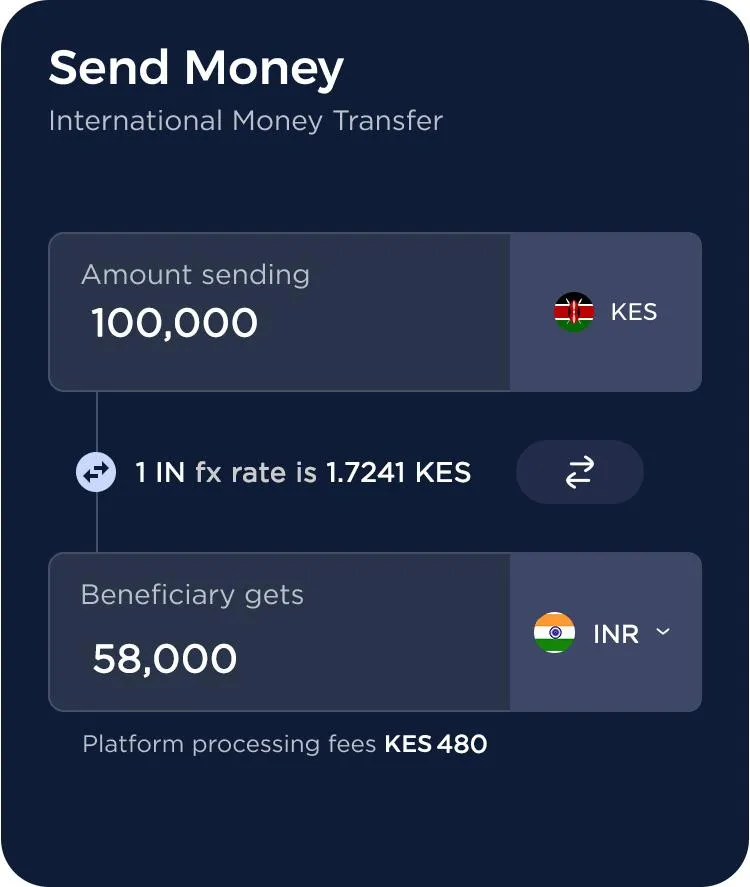

This is how much it will cost you to send money to send 100,000 INR.

KES to INR = 1.743 (Rate changes daily)

Transfer fee- Kes 460 (Flat fee)

=(100,000x1.743)+460

=ksh 174,760

You'll save= 12.03%

This is how much it will cost you to send money to send 100,000 INR.

KES to INR = 1.743 (Rate changes daily)

Transfer fee- Kes 480 (Flat fee)

=(100,000x1.743)+480

=ksh 174,780

You'll save= 12.03%

Pay low fees

Pay low fees

You will only pay KES 460 for any transfer to India.

(you'll always see the total cost upfront).

You will only pay KES 480 for any transfer to India.

(you'll always see the total cost upfront).

No hidden fees

No hidden fees

Absolutely no hidden fees. It's more affordable than what you're accustomed to.

Absolutely no hidden fees. It's more affordable than what you're accustomed to.

How long will a money transfer take?

How long will a money transfer take?

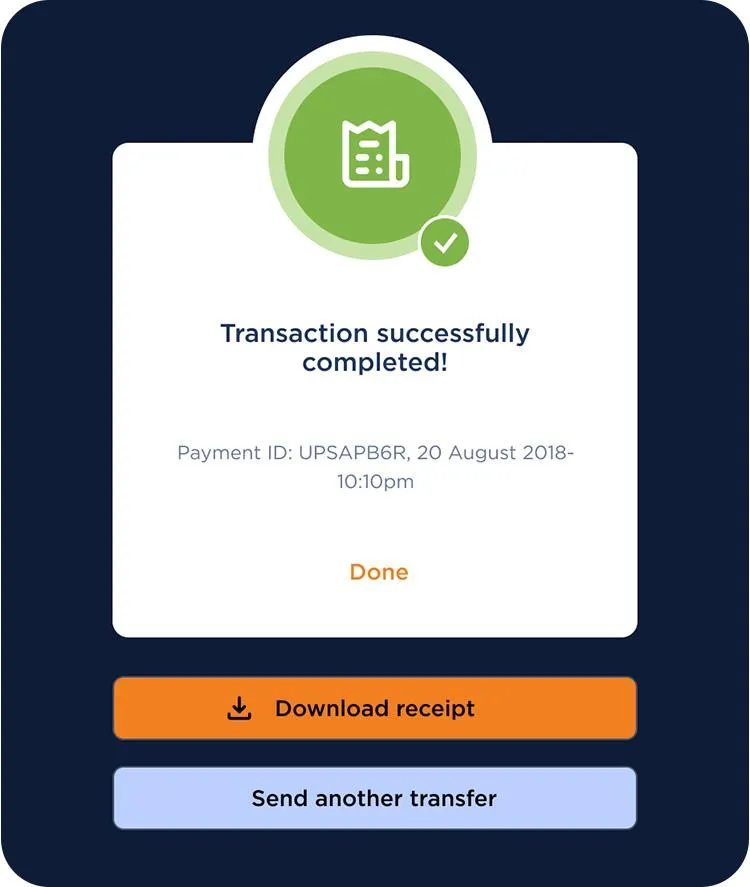

We offer instant money transfers to India.

Occasionally, different payment methods or routine checks may affect the transfer delivery time.

We’ll always keep you updated, and you can track each step in your account.

We offer instant money transfers to India.

Occasionally, different payment methods or routine checks may affect the transfer delivery time.

We’ll always keep you updated, and you can track each step in your account.

How To Send Money to India from Kenya

How To Send Money to India from Kenya

Enter amount to send in KES

Send the money in KES from your bank account or from Mpesa account

Send the money in KES from your bank account or from Mpesa account

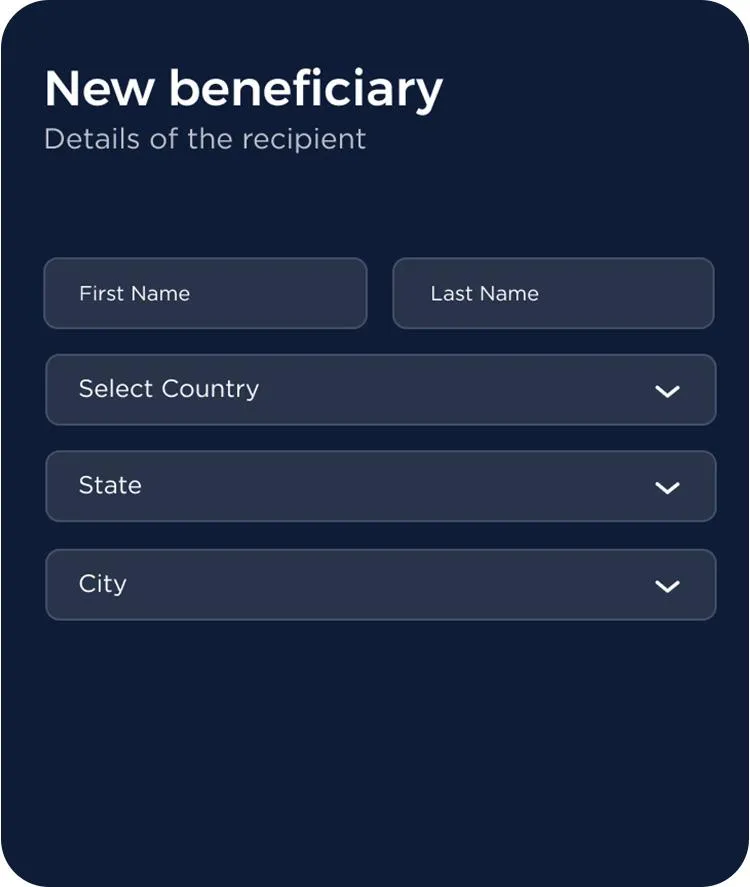

Add your recipient's details in India

Add your recipient's details in India

Add the details of who you want to send money to in India and which pay-out method to use.

Add the details of who you want to send money to in India and which pay-out method to use.

Send KES, receive INR

The recipient gets money in INR directly from Upesi.

The recipient gets money in INR directly from Upesi.

What you’ll need for your online money transfer to India

What you’ll need for your online money transfer to India

Reasons you'll love Upesi

Reasons you'll love Upesi

Best ways to send money to India

Best ways to send money to India

Why Our Customers Love Upesi

Why Our Customers Love Upesi

Register For a FREE Account

Register For a FREE Account

FAQs

Need more answers? Visit our help center here.

Upesi Money Transfer is committed to ensuring the security and protection of the personal information that we process, and to provide a compliant and consistent approach to data protection. Please note that by sharing your information you are simultaneously agreeing to receive information and marketing material that is relevant to Money Transfer solutions and any other valuable information that Upesi Money Transfer deems helpful and relevant to you. If you have any questions related to our GDPR compliance, please contact our Data Protection Officer or make visit our legal and privacy policy page.

Upesi Money Transfer is committed to ensuring the security and protection of the personal information that we process, and to provide a compliant and consistent approach to data protection. Please note that by sharing your information you are simultaneously agreeing to receive information and marketing material that is relevant to Money Transfer solutions and any other valuable information that Upesi Money Transfer deems helpful and relevant to you. If you have any questions related to our GDPR compliance, please contact our Data Protection Officer or make visit our legal and privacy policy page.